BRICS and critical minerals

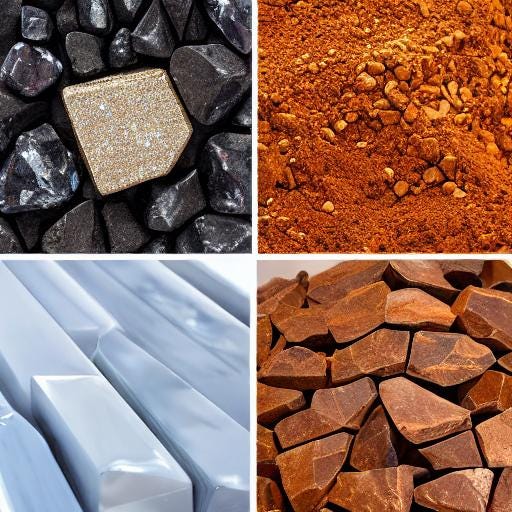

BRICS may manipulate the world of innovation through its resources of critical minerals

At the recent BRICS summit in South Africa, the topics of de-dollarization and expanding the membership of the group were discussed. Slated to join in by 2024 are Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates. These trends could undermine the contemporary financial and economic structures that have been dominated by the developed West. Considering that the nominal GDP of BRICS members consists of 42% of the world population and accounts for 27% of global GDP, the statements about changing the international order is unsurprising. However, the most critical blow to the current system should be highlighted: Minerals that are critical to the global economy and the development of technology are primarily sourced from BRICS countries.

For example, China dominates the critical minerals sector with 60% production and 85% processing capacity. The Asian giant processes more than half of lithium, cobalt, and rare earth elements, and around a third of copper and nickel which are considered key resources of clean energy transition. Furthermore, China is taking the lead in deep sea mining as China’s State Shipbuilding Corporation demonstrated the country’s first oceanographic drilling capable of mining 10,000 deep.

As for other BRICS members, Russia controls the global production of 4% cobalt, 38% palladium, 5.7% platinum, and 11.2% nickel while Brazil is rich in iron ore, tin, copper, pyrochlore, and bauxite. Incorporating Saudi Arabia (the second country with 16.2% of global oil reserves) and Argentina (one of the lithium triangle countries) presents the block an opportunity to shake the international economy and further political stability when members reach a consensus.

The recent restrictions from Beijing on germanium and gallium to retaliate against the semiconductor restriction of the US presented how the critical minerals sector can be manipulated by an actor in the supply chain. In another case, the Russo-Ukrainian war raised the risk of supply chain disruption.

Ludovic Subran argues that BRICS could change into an OPEC-like organization. A similar cartel of Brazil, Russia, India, China, and South Africa along with Saudi Arabia, the United Arab Emirates, Egypt, Ethiopia, and Argentina will be able to generate turbulence in the global economy.

However, the case may turn out to be more serious for the West. The development track of the Trade War between the US and China in the field of technology and the “sanction war” with Russia following the Ukrainian crisis demonstrated how the world is polarized despite the globalization of more than 30 years.

The first cutting-edge-technologies group of countries including the US, the EU, Japan, and South Korea weaponized their know-how, licenses, and scientific research to impose trade limits and destroy the economic advances of their rivals. The group’s ties have tightened with several agreements and their actions against a universal enemy are better organized. For instance, China’s access to advanced technologies such as EUV machines has been constrained for years.

On the other hand, the second consultation table of critical material producers is growing based on BRICS. Without a civilizational core, the participants of the block can only come to an anti-hegemony ideology that intends to overthrow the dictation of global affairs by Washington. For that ambition, joint restrictions of critical minerals to the United States and its allies put inflated costs on technology industries and broke the supply of significant elements.

In other words, a new stage of economic warfare in the field of technology is on the brink that forces both sides to focus on re-shoring or friend-shoring strategies. The West is planning to locate critical mineral production in friendly countries while China and Russia struggle to develop innovation capacities.

Consequently, the regrouping of powers – this trend will be complete when BRICS members have reached a complete organizational structure and system – fuels the technological polarization of the world. Neutral poles which possess rich resources find themselves at the center of geopolitical competition. Indonesia, Chile, and the Democratic Republic of Congo fall into this group. They can play an important role in decreasing the dependence of the West on the critical minerals supply of BRICS.

The capacity of organized BRICS may be beyond de-dollarization and acquire influence on the critical minerals sector. In this way, the technological industries of the USA, the EU, Japan, and South Korea may undergo inflated costs and supply interruptions.

This work was originally published in Eurasian Affairs and republished with the consent of the author.